Featured post

- Get link

- Other Apps

Mudra loan

Hello friends Startup Consultant and Company Secretary

Welcome back once more

in this informative show of neusource

Friends after starting a business To run it

Or to make the business bigger

We often need money

Most of us people

Start a business by putting all their deposits

And if everything goes

well then the business goes on

And friends running the business

We all think of it one day

That the business should be increased now

Should be taken to a higher level

Like if your business is currently proprietorship

So you can make a company now

Now you do offline business

So now you can go online

Do business at local level

So now you can go to the national level

Or your business in any way

Your goal is to enlarge

Then you have only one question

That to increase business

Where will the money come from

Because all the capital

Business takes time to start

So what to do now

M s m e Mudra loan

Because friends if at the right time

Get the right facilities to any business

Then his chances of being successful increase

And if help is not available at the right time

Don't get a chance to move again freinds

And keeping this in mind

The government has launched such a scheme

So that your business

Necessary facilities can be provided

What is the government's plan

How does this help your business

May help to advance

And what are the formalities or requirements

You can avail this plan by completing

Friends answer all these questions

I am going to give you this video today

So stay till the end

And watch the video completely

So let's start

Friends is the name of this scheme

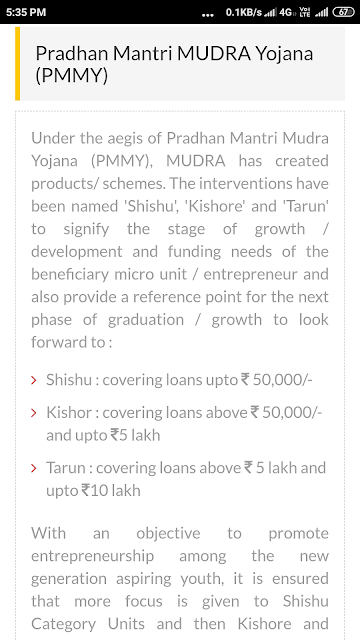

Pradhan Mantri Mudra Yojna (PMMY)

It was launched by the Government of India

On April 8, 2015

Under which non-agriculture, non

Small and related cooperative sector

To micro industries

Amount up to Rs 10 lakh

Was announced as a loan

PMMY means Pradhan Mantri Mudra Yojana

Was one of the major objectives of

People taking loans

Bringing in a formal financial sector

Freinds Under Pradhan Mantri Mudra Yojana

This facility is provided

Mudra loan,

Micro Units Development and Refinance Agency Ltd

Is known as

MUDRA LOANS ANY COMMERCIAL BANK

Small financial bank

micro finance institutions

non banking financial company

Can be obtained by visiting

To take a loan

any of branch of these institutions

By going to the nearest

or else

On the respective bank's online website

Can be applied

at the beginning of this plan

It was formed as a subsidiary of SIDBI.

That acts like a financial company

The scope of the Mudra scheme is wide,

Whose main responsibility

Qualified and involved in certain activities

Providing loans to micro industries

To ensure their development

Pradhan Mantri Mudra Yojana for the same purpose

Has given loans to these institutions

Even at the microscopic level

Chosen to offer micro finance

To the lowest level of society

Loans, financial education, employment generation

And help socialize

Micro finance,

An effective economic development

May prove to be weapon

Friends

Pradhan Mantri Mudra Loan

The objective of Scheme is

Providing loan to needy people

Such as

Hawker

Shopkeepers, small traders and

People connected to other services

Providing necessary loans

other than this

Non-Corporate Small Business Segment

Which has millions of proprietorship partnership firms

Which are small manufacturing units,

Service Sector Units, Shopkeepers, Fruits

& Vegetable Vendors,

Truck Operators, Food-Service Units

Repair Shops, Machine Operators, Small Industries

Operates as etc.

Providing loan facilities to all of them

The objective of this scheme is

With that friends

Providing funds for machinery and equipment

Providing loans for the transport sector

Etc. are also the major objectives of this scheme

Come, now others related to Mudra Yojana

Also know the major advantages

To avail loan facility under this scheme

Micro and small units will be mainly entitled

To get a Mudra Loan

Any type of property to a person

No need to pledge or security

Nor to

get this loan

No commission of any kind is required

Prime currency loan

As a term loan,

as overdraft facility

From credit letters

bank guarantee or any other form

Can also be in the form of

Friends under PMMY Pradhan Mantri Mudra Yojna

Lone in three parts: Shishu, Kishore and Tarun

Is divided

The first is Shishu loan

This loan facility is for those entrepreneurs

Who are trying to set up their new business

Has started it

Under this scheme

Up to 50,000 rupees

Loan amount is provided

There are some general conditions for this loan.

According to which this loan machinery etc.

Will be given to buy

And also contains a valid quotation

And supplier details will also need to be given

Freinds Then there is Teen loan

Under Mudra Yojana

Kishore scheme is for those entrepreneurs

Who want to increase their business

And looking for new fund for it

In the Mudra Scheme under Kishore Scheme

Rs 50,000 to Rs 5,00,000 Loans are provided.

Freind's

To get this loan

Some mandatory qualifications

More documents are also required

Like the last two years of business

balance sheet,

bank account statement,

sales and purchase returns

projected balance sheet of current year

And the economic of this project

And technical viability etc.

Friends based on all these documents

Ho loan is passed

Now Tarun loan is the last

This loan is for those businessmen Freind's

Who have some capital

Msme loan

And those who already

Has set up his business,

But now they use their business

More expansion and faster growth

Looking for a loan for

Loan amount under this scheme

From Rs 5,00,000 to Rs 1,000,000 ensured

As under this scheme

Loan amount given is highest

So to get this loan

Applicant against other schemes

More documents to be submitted

Such as

project report of business extension

The last two years of business balance sheet

bank account statement,

sales and purchase documents

projected balance sheet of current year

Identity card of the person

And residence certificate

And furthe rmore if that person

is from reserved category

So he has to show his caste certificate too

And your startup's financial and

Technical viability will also be investigated

So friends, after knowing all this

You must have understood this much

You are also being given by the government

Can take advantage of this scheme

If you too for your business

Of Pradhan Mantri Mudra Yojana

Want to take advantage

So keep in mind the things mentioned in this article

Along with this

If you do business registration or

Want to get more information related to startup

So I linked Neusource's mobile application

And visit this site all about full information

Given in the description below

With the help of

which you have a more detailed discussion

From our expert startup consultant

So thanks guys

With this, this topic of today is ended here

We meet again

With a new topic

And take care if you have any other topic

But if you want a video

For that you can message us in the comment box.

Thank you

India Mudra loan

Comments

Post a Comment